The following is our monthly market report update for your reference.

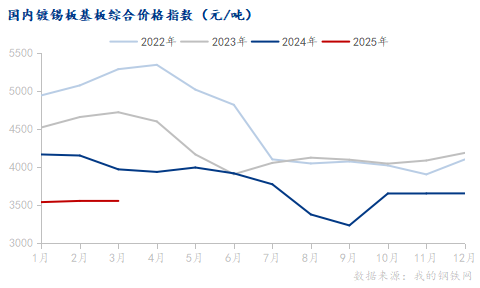

- Tinplate Price Changes

Baosteel, Winsteel, MeiSteel: Prices for tinplate and chrome-plated steel remain unchanged.

Other private tinplate manufacturers: Prices reduced by 50–100 yuan/ton.

- Domestic Tinplate Price Trend

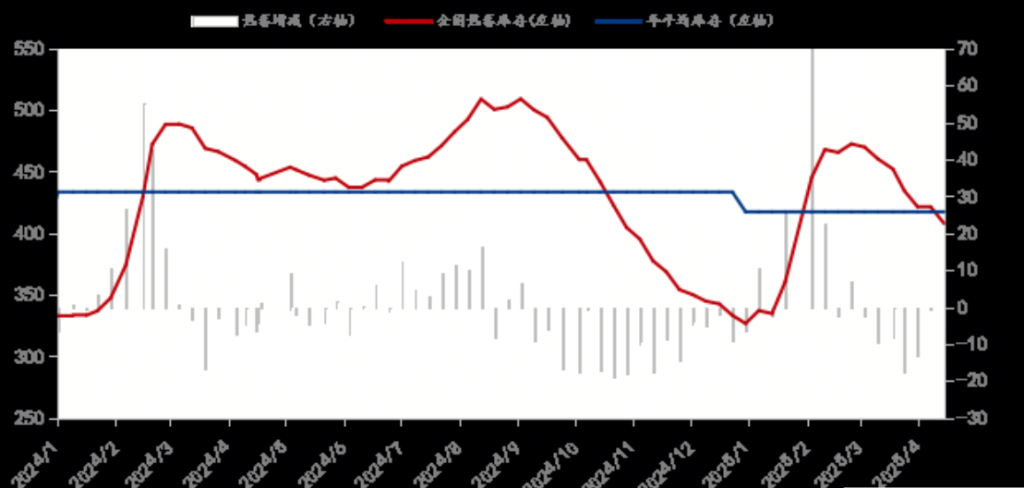

- Raw Material Market Trends

Weak performance in hot-rolled coil prices amid cautious market sentiment.

- Hot-rolled Coil Inventory Monitoring Data

Baosteel, Bensteel, Ansteel: Hot-rolled prices unchanged

Under largely stable fundamentals, market prices fluctuate based on trading platforms. Downstream procurement remains cautious, with declining inquiries and pessimistic sentiment among traders. Despite positive Q1 economic data, lack of upward drivers limits demand recovery.

Short-term outlook: Hot-rolled coil prices to remain weak.

- Spot Price Trends for Tin Ingots in Major Markets

Shanghai tin average price: 259,550 yuan/ton, down 3,850 yuan/ton week-on-week.

- Other Market Updates

3.1 USD/CNY Exchange Rate

- The RMB Exchange Rate Trend

The RMB exchange rate shows a fluctuating upward trend against the USD.

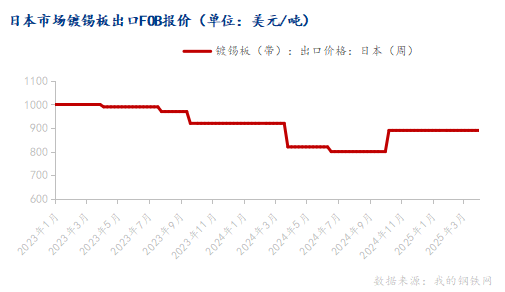

3.2 Japan’s Tinplate Export Prices (FOB)

- Japan’s Tinplate FOB Offer

Japan’s tinplate export prices stabilize with FOB quotes at $890/ton, unchanged week-on-week.

3.3 Tinplate Export Data

February 2025: China’s tinplate exports totaled 137,000 tons (+12.03% YoY).

January-February 2025: Cumulative exports of 285,000 tons (+19.67% YoY).

March 2025: Exports surged to 169,100 tons (+67.27% YoY).

Q1 2025: Total exports reached 454,100 tons (+33.85% YoY).

Chrome-plated steel exports:

March 2025: 55,800 tons (+45.99% YoY).

Q1 2025: 140,200 tons (+51.84% YoY).

3.4 Production Data

March 2025: Tinplate operating rate at 78%, capacity utilization at 74.4%.

Monthly output: 434,800 tons (+27,400 tons MoM).

Inventory: 199,300 tons (+16,000 tons MoM).

Chrome-plated steel output: 131,800 tons (+16,000 tons MoM).

- Detailed Analysis of China’s Tinplate Market (Feb-Mar 2025)

In some markets such as the United States, Israel, and Mexico, import volumes surged by 125,267%, 2,232%, and 353% year-on-year, respectively, while traditional markets like Italy, Spain, and South Korea experienced significant declines of 90%, 82%, and 21% YoY. These drastic fluctuations of “simultaneous surges and drops” reflect shifts in global supply chains, highlight the complexity of geopolitical dynamics and trade policies, and provide a critical lens for analyzing trends in the tinplate export-import landscape.

4.1 Analysis of Regions with Significant Growth

- United States

In February 2025, the U.S. announced plans to impose a 25% tariff on Chinese steel products, triggering panic over anticipated trade policy changes. To avoid future tariff costs, Chinese exporters accelerated concentrated shipments to the U.S. between January and March 2025, causing a short-term surge in exports. Data shows that exports to the U.S. in the same period of 2024 were only 23.24 tons, but skyrocketed to 29,135.37 tons in January – February 2025. Additionally, some orders previously routed through third countries like Vietnam to bypass U.S. tariffs were shifted to direct exports due to concerns over U.S. Customs traceability checks, further inflating the figures.

- Tunisia

Reports indicate that Tunisia initiated the construction of five large-scale agricultural processing plants in 2024, primarily producing olive, tuna, and tomato canned goods. By February 2025, three plants had become operational, with the remaining two expected to be completed in Q3 2025. Traditionally reliant on French imports, Tunisian food packaging companies pivoted to Chinese suppliers due to soaring natural gas prices in Europe, which reduced local tinplate production capacity and raised costs. China’s price competitiveness led to a surge in short-term tinplate orders, creating a concentrated procurement peak.

- Israel

The large-scale conflict in Gaza in 2024 directly triggered explosive demand for emergency construction materials and food packaging supplies in Israel. This unique combination of wartime stockpiling mechanisms and post-war reconstruction needs drove a historic peak in tinplate imports, with over 60% of orders allocated to military and civilian emergency food-grade tinplate. The bulk of imports occurred in late January 2025. Leveraging the China-Europe Railway Express, Chinese suppliers reduced delivery cycles to approximately 22 days, ensuring timely fulfillment of urgent orders.

4.2 Analysis of Regions with Significant Decline

- Spain

In October 2023, the EU officially included tinplate in the scope of the Carbon Border Adjustment Mechanism (CBAM), requiring importers to submit quarterly reports on the full lifecycle carbon emissions of products. Chinese tinplate, due to its coal-fired production process, has a carbon footprint exceeding EU averages. Once the carbon tariff is formally implemented, export costs will increase. By 2024, Spain’s canned olive exports had declined by 17%, reflecting structural demand contraction in the industry. Rapid restructuring of Spain’s domestic supply chain has boosted annual tinplate production capacity, with priority given to local canning enterprises, forming regional procurement alliances.

- Italy

In recent years, strategic transformation plans by local steel mills in Italy have significantly increased annual tinplate production capacity, with an estimated 600,000 tons dedicated to food-grade tin-coated steel sheets. Industrial protection policies have triggered ripple effects in downstream sectors, leading to partial outward migration of Italy’s canned food production capacity.

- South Korea

As a major consumer of tinplate, South Korea saw a 21% year-on-year decline in imports from China during January-February 2024. This shift reflects structural transformations in South Korea’s steel industry and profound adjustments in global trade dynamics. POSCO (Pohang Iron and Steel Company) has expanded its tinplate production capacity to 1.2 million tons annually through hydrogen-reduced steelmaking technology, boosting domestic market share. Concurrently, South Korea’s food and beverage industry has adopted a “lightweighting” strategy over the past two years, with specific order requirements favoring locally sourced materials.

4.3 Risk Warnings

- Risk of implementation of US tariff policy. If the additional tariffs are officially implemented in April 2025, China’s exports to the United States may face a “vacuum period after rush shipment”, and the export volume in the second half of the year is expected to fall back to less than 30% of the 2024 level.

- Risk of spread of anti-dumping investigations. Countries and regions such as Malaysia and the United Kingdom have launched anti-dumping investigations against Chinese tinplate, which have not yet been settled. If other emerging markets follow suit, it may lead to a further narrowing of global export channels.

- Concerns about the sustainability of demand. Short-term orders overdraw long-term demand, and subsequent quarterly purchases may drop sharply.

- Risk of competition from alternative materials. The tinplate market is facing a strong substitution of aluminum products and plastic packaging. The lightweight and recyclable nature of aluminum is more in line with environmental protection trends. Breakthroughs in biodegradable plastic technology will further erode the share of tinplate in daily necessities packaging. If the tinplate industry cannot cope with competition through technological upgrades, some market share may be permanently lost.

- Market Forecast

Looking ahead to April 2025, we predict that the domestic tinplate market may move forward under pressure. The market generally maintains a cautious and pessimistic attitude towards signals such as increased steel supply and negative feedback pressure from raw materials. In the absence of major positive triggers, it is difficult for sentiment to reverse. From the raw material side, the price of plate varieties in the first quarter of 2025 was strong, the hot-rolled base material of tinplate maintained a range of fluctuations, and the monthly average price did not change significantly. The spot price of tin ingots showed an increase, which was the main support for the current spot price of tinplate. From the supply side, the current production enterprises have maintained their production capacity, and the actual ex-factory price of production enterprises is weak in order to maintain the order rhythm. From the demand side, the current market rigid demand is maintained, and foreign trade pressure is gradually emerging. The demand for stocking food and beverage orders in summer is still on the sidelines, and the spot price fluctuates and weakens. At present, it is in a demand vacuum period to a certain extent.

In summary, the supply and demand of the tinplate market basically maintained a balance in April and May, and the steel market may rebound somewhat, but the differentiation of varieties will further intensify, and the relevant market conditions still need to be observed.

At the same time, after a period of market research, we found that there is currently no anti-dumping trend in various regions against tinplate can lids produced in China, and purchasing can lids from China can greatly reduce operating costs and final product prices and improve product quality.

Service Information

- Competitive DDP door-to-door delivery.

- Customized tinplate solutions tailored to your needs.

- Updated product quotes upon inquiry.

Contact us for further details!